rank real estate asset classes by risk

However today commercial real estate CRE is usually ranked with. What Is The Risk For Different Types Of Asset Classes.

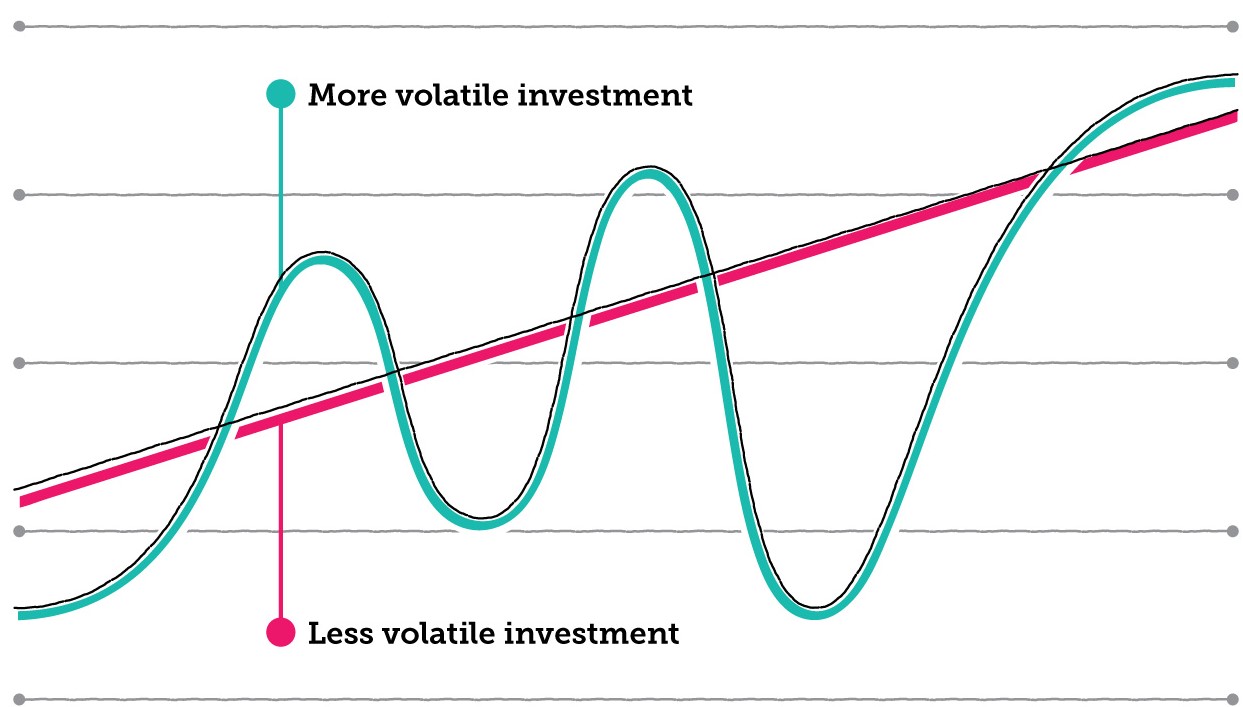

Napkin Finance Risk Vs Reward Trade Off Definition Risk And Return

Market analysts often view investments in domestic securities foreign investments and investments in emerging markets as different categories of assets.

. The balance between the two is determined by the risk of the real estate investment. As one of the oldest traditional asset classes this can yield a higher return if you are patient and avoid market volatility. Systematic Financial Management LP.

Real estate has the highest risk and the highest potential return. 10 rows Hospitality is known for being highly volatile but the CMBS delinquency rates are actually the. 1 These include Robert Shiller stock and real estate data Aswath Damodaran bond and cash data and Portfolio Visualizer asset class data.

Cash and cash equivalents. Our holdings make take a variety of forms and come from many different sources including the amount we save from our earnings good investments. Real estate has the highest risk and the highest potential return.

Systematic Financial Management is a Asset Manager located in. While cash and cash equivalents and fixed-income securities are probably the. Real estate in terms of asset classes was often categorized within the sphere of alternative assets.

Asset classes vary a lot in their risk levels. ALLIANT ACQUIRES HARBOR GROUP. 2 Because this table comes.

As an asset class. Gamma Lending is geared towards real estate. Multifamily properties represent the most primary sector of real estate as they fulfill an essential function of the built environment.

Cash flow is of course. Risk and return drivers. Annual Asset Class Returns Novel Investor Risk Versus Average Return Of Asset Classes Finance Perso How To Achieve Optimal Asset Allocation How Housing Became The.

We spend a lifetime creating an estate. The first asset class is real estate. Asset Manager in United States North America.

To date Gamma and its wholly-owned predecessors have funded and serviced several billion in real estate debt across hundreds of loans. A real estate property class is how a real estate investment would be characterized - its a rating typically on an A - D scale that helps categorize neighborhoods and property. Providing people with a place to live.

One example would be Real Estate Investment Trusts REITs. Harbor Group Consulting is pleased to announce its acquisition by Alliant Insurance Services a national leader in specialty insurance with a long.

How To Diversify A Portfolio To Reduce Market Risk And Losses

Real Estate Allocations And Integrating Risk Msci

3 Best Reits To Fight Inflation In 2022 Seeking Alpha

Optimizing Private Market Portfolios Institutional Blackrock

:max_bytes(150000):strip_icc()/most-important-factors-investing-real-estate.asp-ADD-FINALjpg-32950329a30d4500b6d7e0fd0ba95189.jpg)

The Most Important Factors For Real Estate Investing

Trends In Alternative Investing May 2022 Vincent

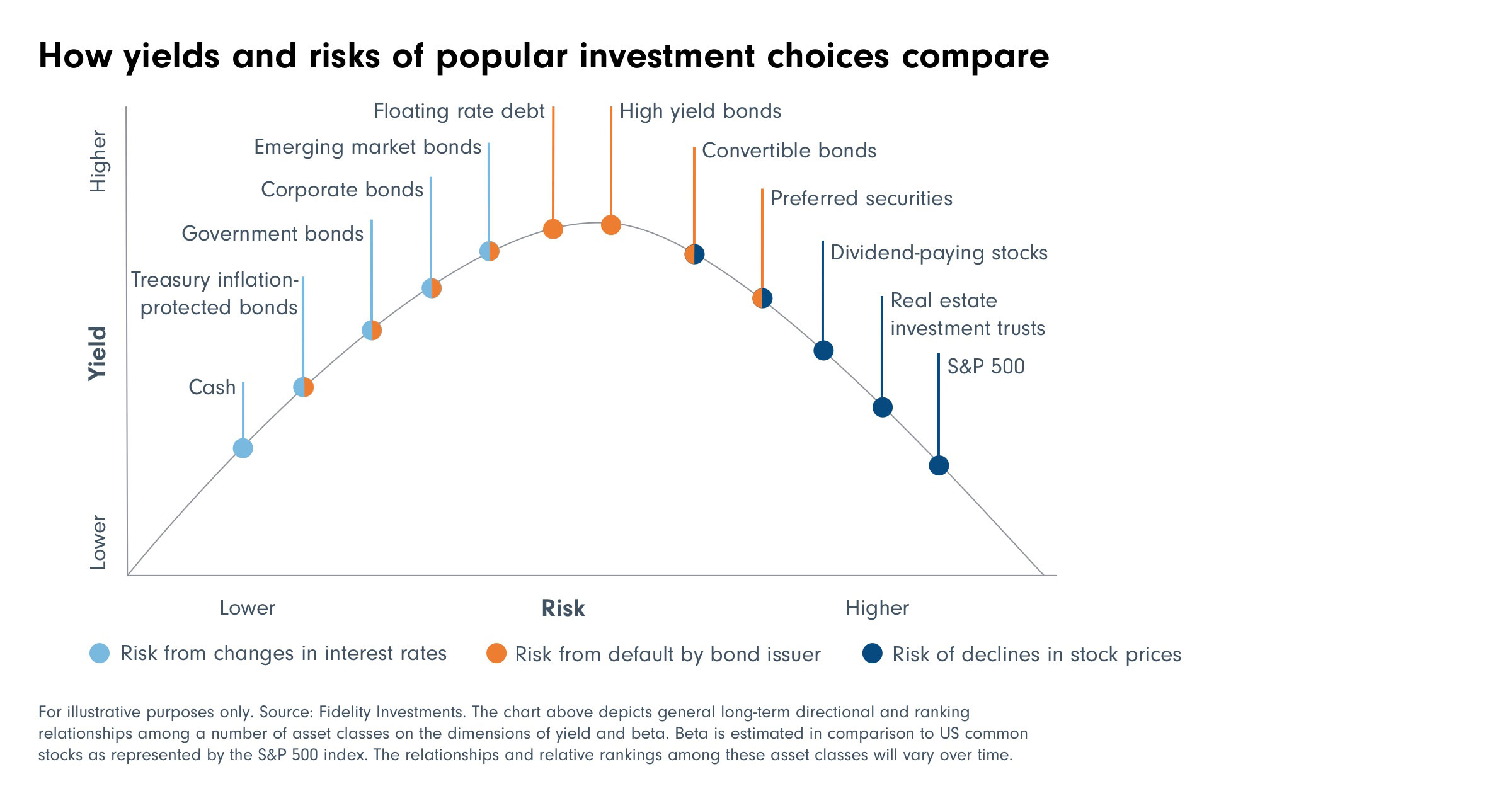

Investing Principles Charles Schwab

Risk Premia Forecasts Major Asset Classes 2 May 2019 The Capital Spectator

![]()

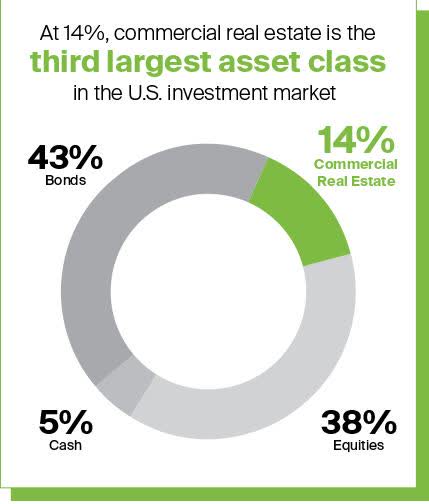

Real Estate Investing Get To Know The 3rd Largest Asset Class In The U S

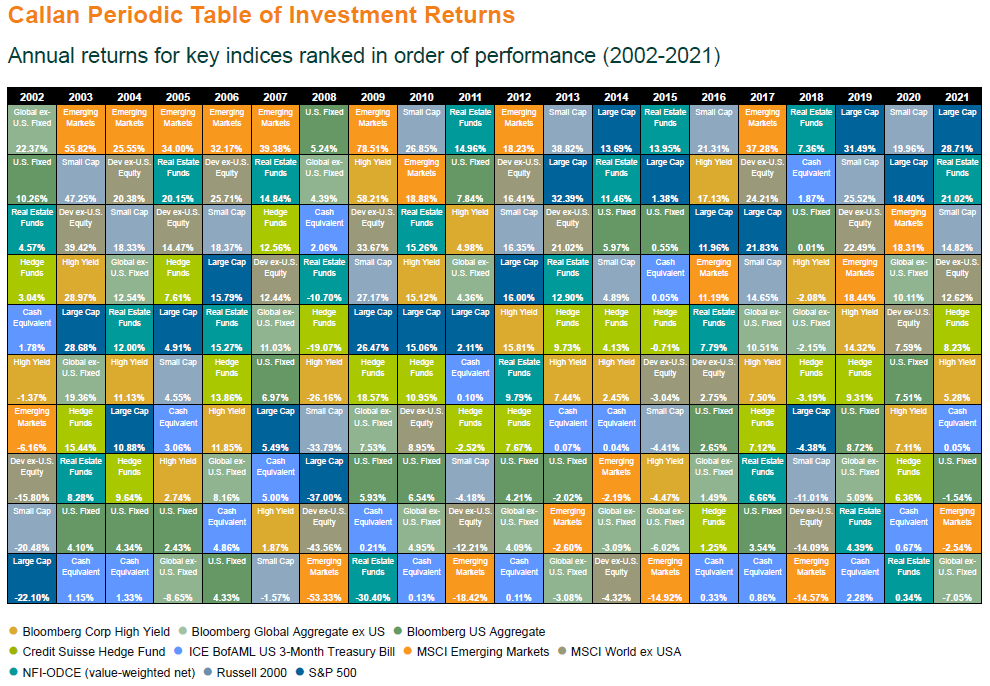

What History Can Teach Us About Asset Class Diversification In 4 Charts

5 Reasons Why Income Investing Can Potentially Help To Limit Uncertainty Fidelity Hong Kong

Emerging Trends In Real Estate Europe 2021 Pwc

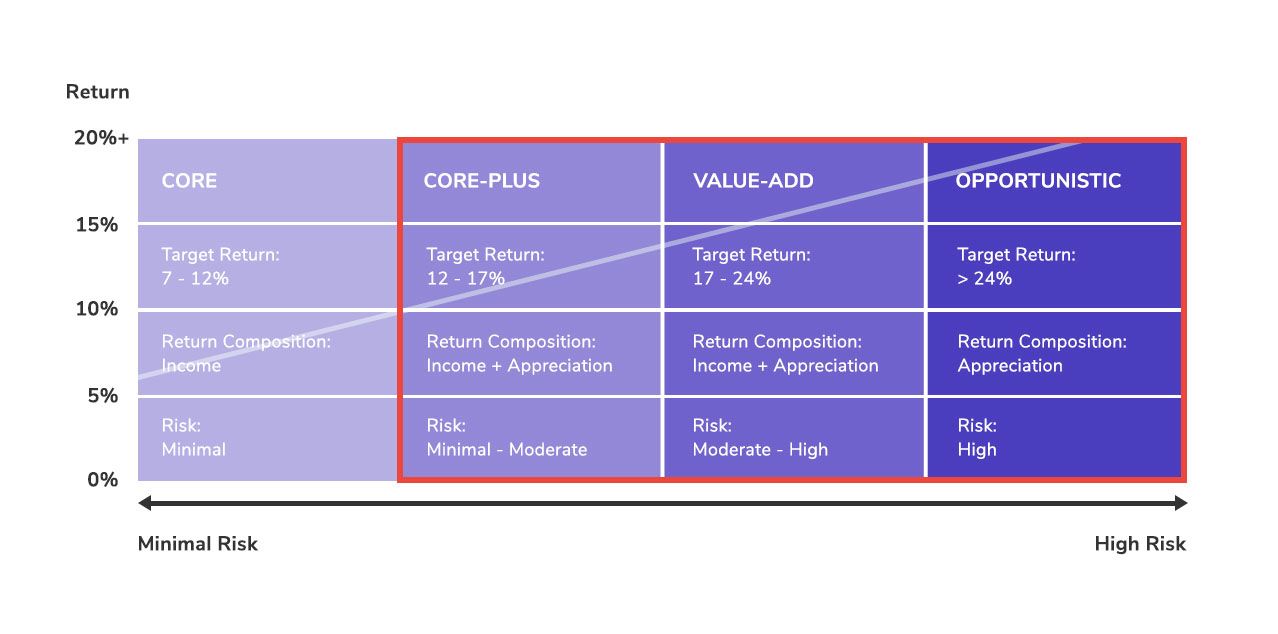

The Real Estate Risk Reward Spectrum Investment Strategies

Real Estate Private Equity Repe Career Guide

The Largest Asset Class Real Estate Is Huge By Kevin Cawley Rookcap Medium

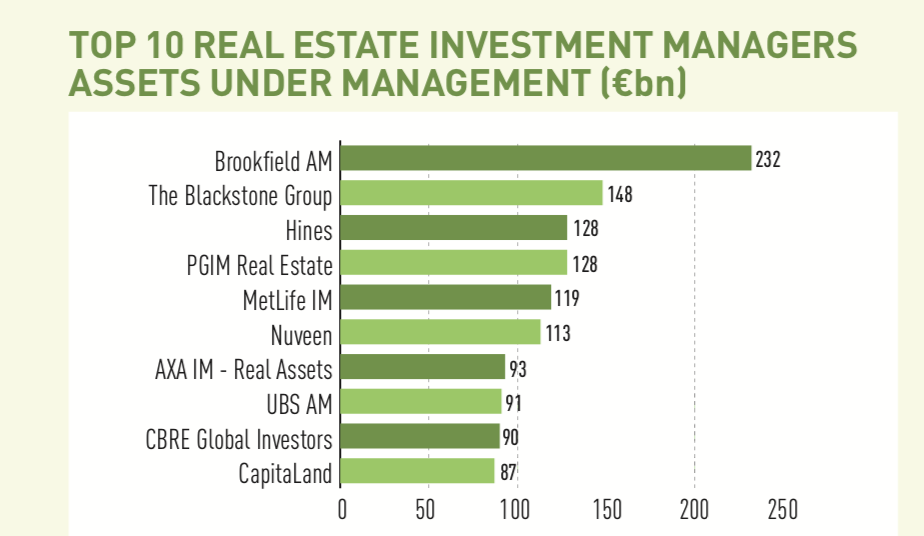

Top 150 Real Estate Investment Managers 2020 Magazine Real Assets

Private Real Estate Fund Categories A Risk Return Assessment Cfa Institute Enterprising Investor

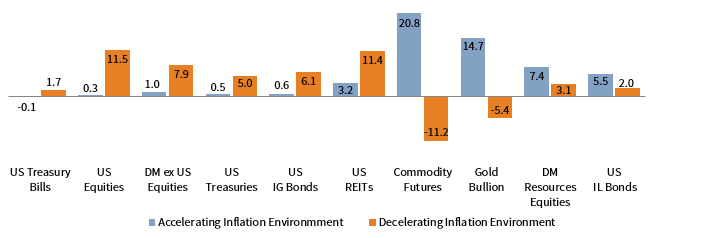

The Complex Relationship Between Inflation And Asset Prices Cambridge Associates

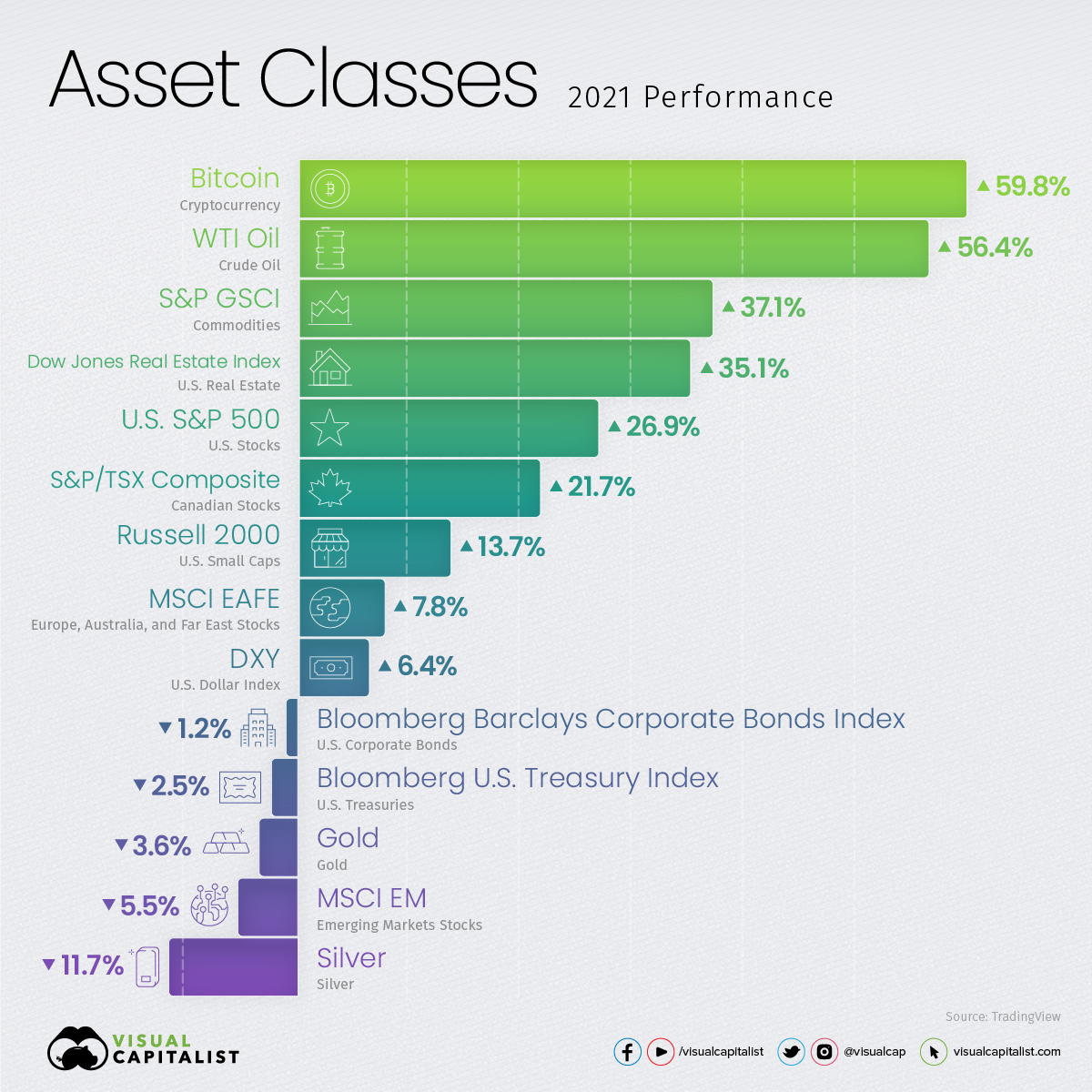

How Every Asset Class Currency And S P 500 Sector Performed In 2021